Value-based pricing formula explained (with free worksheet)

Alvaro Morales

Alvaro MoralesWhile energy, funding, and innovation in AI have never been higher, companies building AI products are struggling to monetize in a way that SaaS companies never encountered.

At Web Summit 2025, Orb CEO and co-founder Alvaro Morales shared the two reasons why monetizing AI is uniquely difficult and the strategies that Orb customers and other leading AI companies are using to turn that challenge into durable revenue. Drawing on Orb’s vantage point across many of the fastest-growing AI businesses, his keynote also offered a window into the future of AI monetization and how pricing strategies will evolve in 2026 and beyond.

AI has inverted the economics of software. In SaaS, there are high fixed costs and near-zero marginal costs. Serving more users costs close to nothing, which results in 80% to 90% margins.

With AI, every query and inference carries real marginal cost. While per-token prices are declining, total token usage is exploding. This means more usage can actually create bigger losses if your pricing strategy isn’t aligned with your cost structure.

Companies that price AI products like flat SaaS subscriptions are discovering this the hard way. Their margins compress as customers drive up usage without corresponding revenue increases.

Usage-based pricing offers a solution to the AI pricing paradox. By directly aligning revenue with costs, companies are able to protect their margins as they scale.

However, usage-based pricing has its own challenges. Customers don’t want surprise bills, and finance teams want predictable spend. Usage-based pricing feels unpredictable, which can be a barrier to adoption, especially for enterprise customers.

This is why hybrid pricing has emerged as the dominant pricing strategy. We found that 92% of AI agent products have adopted hybrid pricing, which combines multiple pricing components into one model. Most commonly, it combines predictable subscription fees with variable usage-based components.

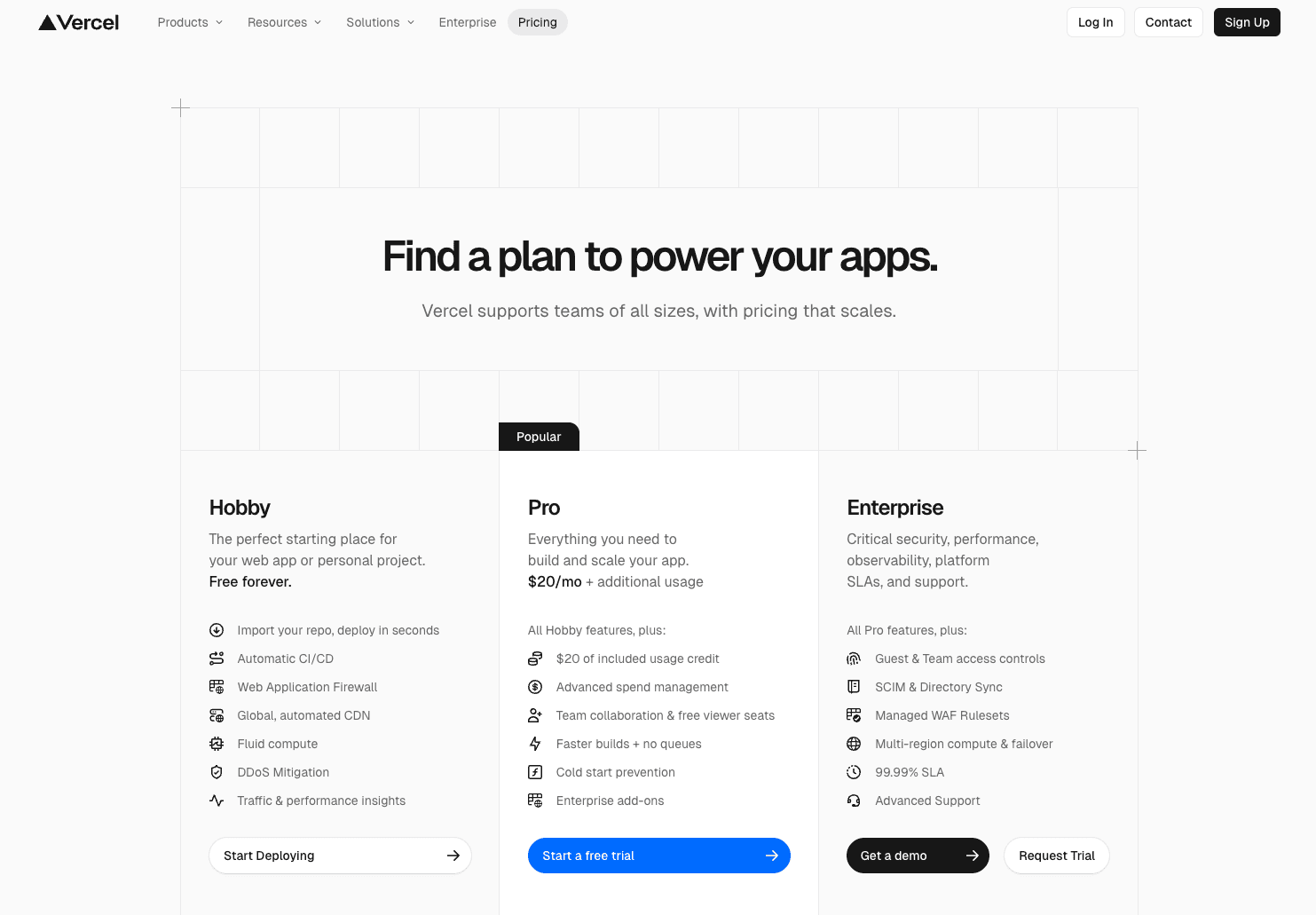

Take Vercel as an example. Their pricing layers freemium access, a free trial, subscriptions, and usage-based fees into a cohesive structure that provides both predictability and flexibility.

Even when revenue scales with cost, that doesn’t mean it’s connected to the value customers actually feel. If customers don't see clear value in what they're paying for, your pricing won't work. You’ll create friction in the sales process, make it harder to justify pricing during renewals, and see customer churn.

The disconnect stems from how AI products create value. Unlike SaaS, where value is tied to features and seat counts, AI products generate value that varies by user, workflow, or use case.

Bridging the gap between what you measure and what customers value requires new models, new infrastructure, and a fundamentally different approach to how pricing decisions are made.

Outcome-based pricing is one of the most talked-about ideas in AI monetization, but adoption still lags behind the hype. In outcome-based models, customers pay for results such as support tickets resolved, leads generated, or documents processed. This aligns pricing with the value customers actually perceive.

Despite industry-wide interest, adoption is still low. Our data shows that only 4.5% of AI agent products offer outcome-based pricing. Of those, two-thirds offer it in addition to at least one other pricing model. This reflects how complex it is to operationalize in practice, as outcome-based pricing requires:

Over the next few years, outcome-based pricing is likely to become more common. As AI products mature and demonstrate clear ROI, customers will become increasingly comfortable with paying for outcomes rather than inputs. Companies that build the measurement infrastructure and operational processes to support outcome-based pricing today will have a competitive advantage when this happens.

The most successful companies aren’t chasing a single “perfect” pricing model. They’re building the ability to experiment quickly.

Pricing experimentation is now a competitive advantage, but most companies are constrained by legacy billing infrastructure, engineering dependencies, and systems that were never designed for agility and flexibility. Implementing a pricing change takes months while faster-moving competitors are able to iterate multiple times in that same timeframe.

Organizations that effectively monetize their AI products embrace pricing innovation as a core part of their AI strategy, not an afterthought. Orb customers such as Replit are the ones leading the way with new, innovative pricing models that more closely align price with value.

Last year, Replit introduced effort-based pricing where more advanced, complex agent requests that cost more to serve also cost the customer more. These requests are more valuable to customers, so this new model tightens the alignment between cost and perceived value.

Companies that will succeed in this era are the ones that:

The challenge of effectively monetizing AI is only becoming more urgent as usage scales, margins are compressed, and customers scrutinize ROI. But it’s also an opportunity for companies that can get pricing right while their competitors are still figuring it out.

If you’re interested in learning more about how to turn pricing into your organization’s competitive advantage, contact us for more information.

See how AI companies are removing the friction from invoicing, billing and revenue.